what percent is taken out of paycheck for taxes in massachusetts

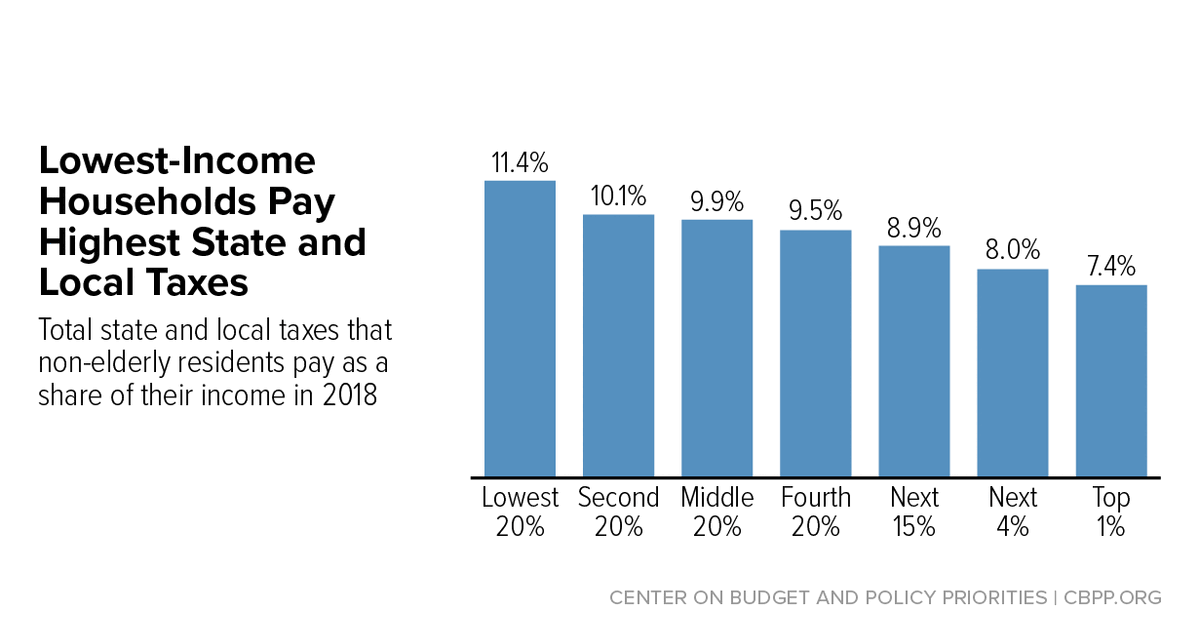

Payroll taxes in Massachusetts It doesnt matter how much you make. Total income taxes paid.

Massachusetts Paid Family Leave Not Calculating Correctly

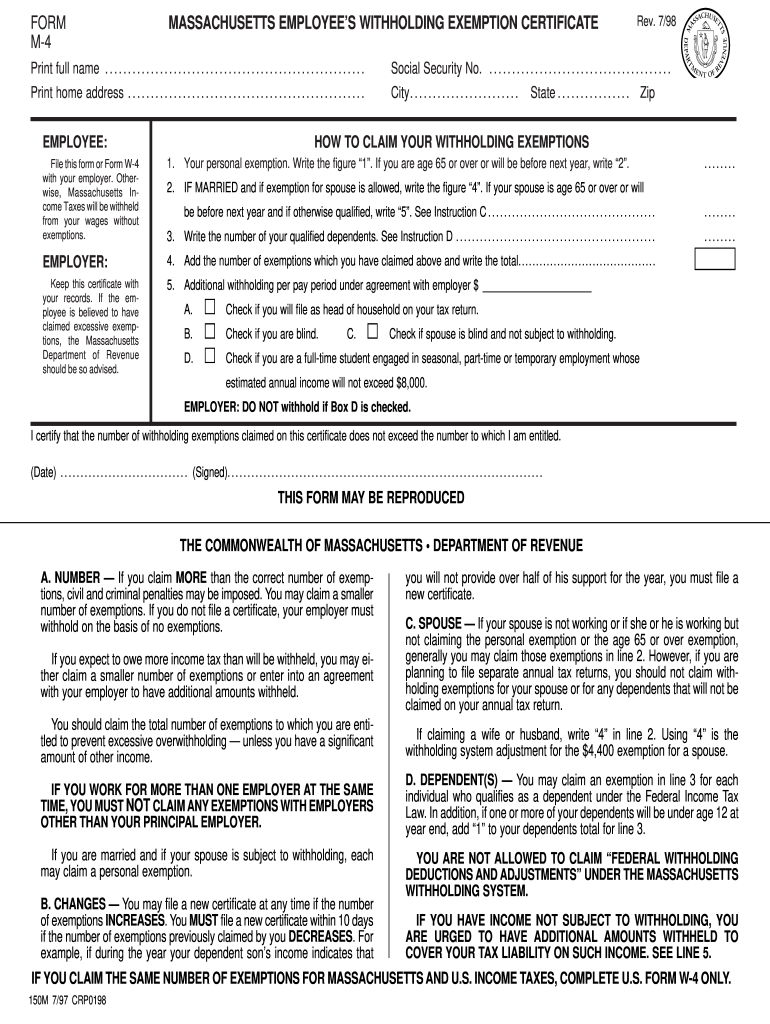

Your new employees should fill out.

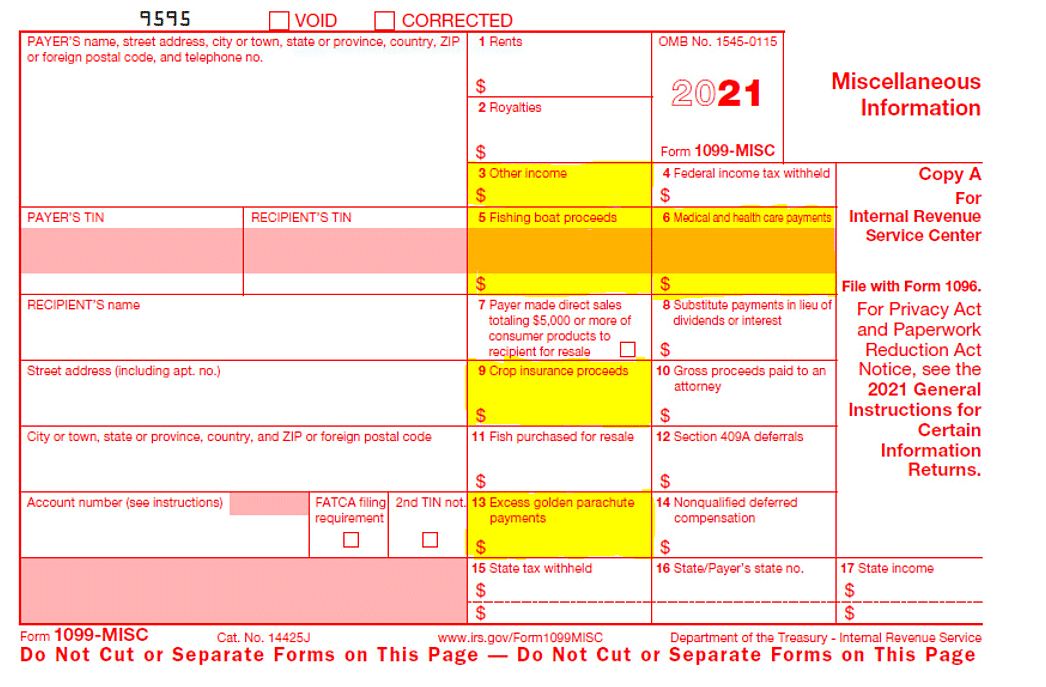

. Your average tax rate is 1198 and your. Subject to Paid Family and Medical. The amount of federal and Massachusetts income tax withheld for the prior year.

That goes for both earned income wages salary commissions and unearned income interest and dividends. What percentage is taken out of your paycheck for taxes in Massachusetts. On or before April 15 for calendar year filings.

See answer 1 Best Answer. Massachusetts is a flat tax state that charges a tax rate of 500. The income tax rate in Massachusetts is 500.

The total Social Security and Medicare taxes withheld. In 2022 if you are a new non-construction business you will. The tax rate is 6 of the first 7000 of taxable income an employee earns annually.

These are the federal tax brackets for the taxes youll file in 2022 on the money you made in 2021. Massachusetts is a flat tax state that charges a tax rate of 500. Supports hourly salary income and multiple pay.

Tax year 2021 File in 2022 Nonresident. Contacting the Department of. That goes for both earned income wages salary commissions and.

Amount taken out of an average biweekly. Unlike with the federal income tax there are no. The 15th day of the 4th month for fiscal year.

Amount taken out of an average biweekly paycheck. 3 rows the income tax is a flat rate of 5. Massachusetts Income Taxes.

This free easy to use payroll calculator will calculate your take home pay. Income amounts up to 9950 singles 19900 married couples filing. Just enter the wages tax.

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Overview of Massachusetts Taxes Massachusetts is a flat tax state that charges a tax rate of 500. No local income tax.

Massachusetts Hourly Paycheck Calculator. Massachusetts Income Tax Calculator 2021. No Massachusetts cities charge their own local.

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Note that you can claim a tax credit of up to 54 for paying your Massachusetts. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

That goes for both earned income and unearned income. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Rates are generally determined by legislation.

That rate applies equally to all taxable income. Rates for 20220 are between 094 and 1437 depending on your claims history. As of January 1 2020 everyone pays 5 on personal income.

Massachusetts Paycheck Calculator 2022 With Income Tax Brackets Investomatica

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Here S How Much Money You Take Home From A 75 000 Salary

Everything You Need To Know About Restaurant Taxes

2022 Federal State Payroll Tax Rates For Employers

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

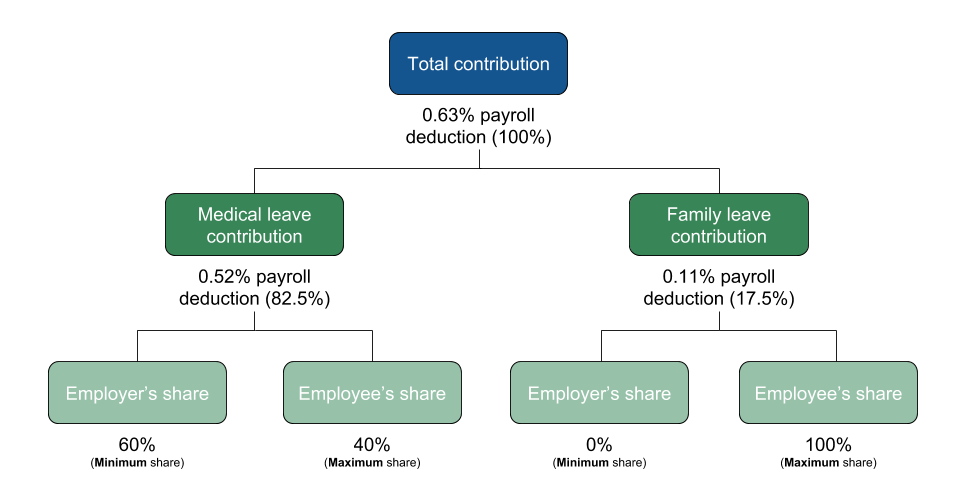

Massachusetts Paid Family Medical Leave Accountedge Knowledge Base

Ma Dor M 4 1998 Fill Out Tax Template Online Us Legal Forms

Free Massachusetts Payroll Calculator 2022 Ma Tax Rates Onpay

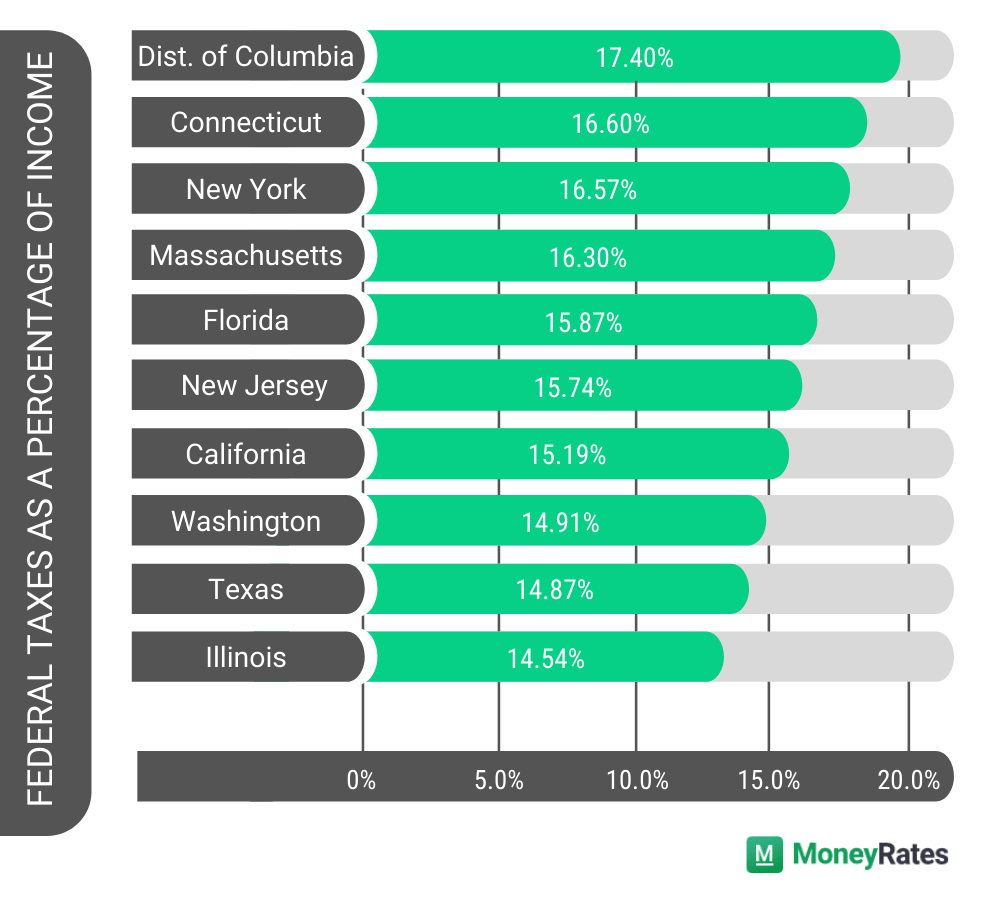

Which States Pay The Most Federal Taxes Moneyrates

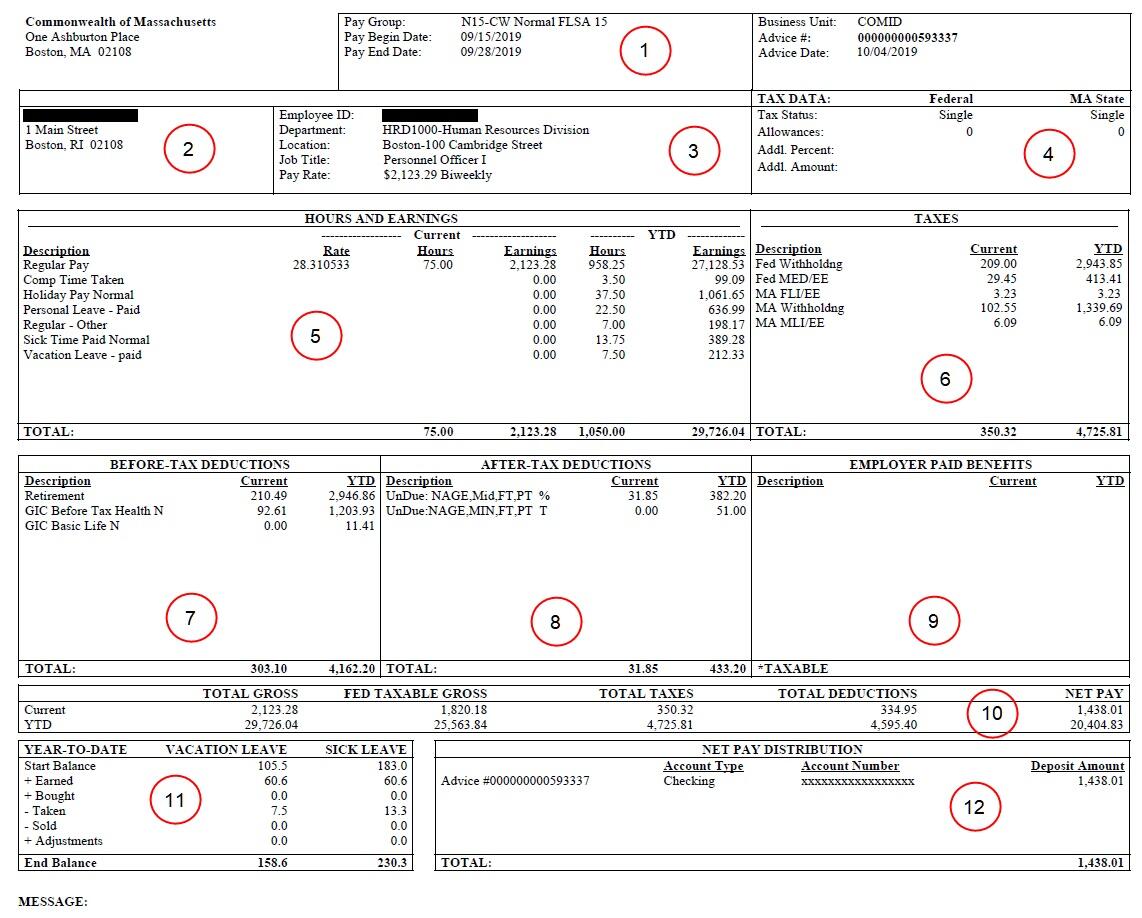

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Wage Deductions Under Massachusetts Law Slnlaw

State Local Tax Impacts Of Covid 19 For Massachusetts 2022 Forvis

Massachusetts Paycheck Calculator Smartasset

Learn More About The Massachusetts State Tax Rate H R Block

Massachusetts Announces Contribution Rates Effective July 1 For Paid Family Leave

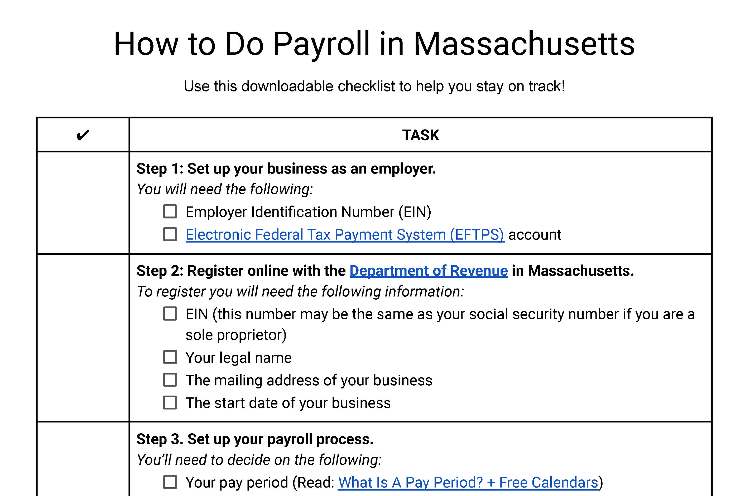

How To Do Payroll In Massachusetts What Every Employer Needs To Know

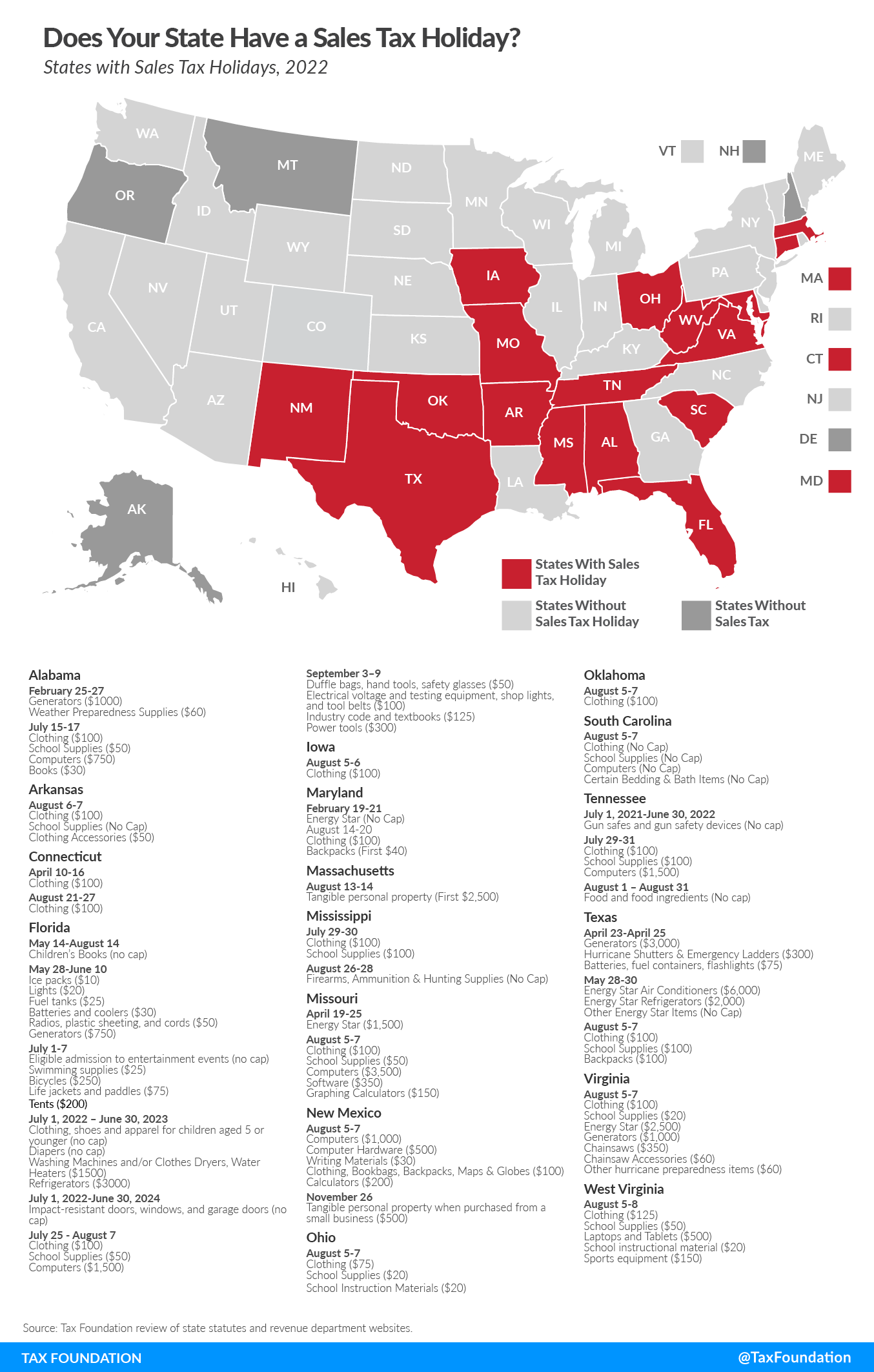

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov